Good news Indonesia's biggest coal mine 5 times larger than Singapore

In total, the area has an estimated 1.27 billion metric tons of coal resources, according to Adaro, mainly coking coal used to make steel.

In detailed responses to questions, BHP says it is making progress on developing the first mine in the complex, called Haju. Infrastructure development is underway, including road works and a port along the Barito River. Haju is planned to produce one million metric tons of coal per year. Haju mine itself will cover 660 hectares and initial production is expected in 2015, BHP says.

IDX to Simplify IPO Requirements for Mining Companies

Global miner BHP Billiton and Indonesian partner PT Adaro are developing what could become the single largest mine in Indonesia in terms of land area, with BHP owning 75 percent. The IndoMet mine complex in Central and East Kalimantan provinces on Borneo comprises seven coal concessions, which cover 350,000 hectares, or about five times the size of Singapore.In total, the area has an estimated 1.27 billion metric tons of coal resources, according to Adaro, mainly coking coal used to make steel.

In detailed responses to questions, BHP says it is making progress on developing the first mine in the complex, called Haju. Infrastructure development is underway, including road works and a port along the Barito River. Haju is planned to produce one million metric tons of coal per year. Haju mine itself will cover 660 hectares and initial production is expected in 2015, BHP says.

The company says the current area covered by the seven concessions will be reduced over time and returned to the government, in line with regulations that mandate 50 percent of the exploration area be returned within a set timeframe. That means the mandated maximum holding of the total area of the seven concessions is expected to be no more than about 175,000 hectares, BHP says.

Conservation groups, such as the Indonesian Forum for the Environment (or Walhi) fear the project will cause widespread deforestation in an area of the province that still has large areas of rainforest. “It is expected that only a fraction of this area will be actively mined at any given time, about 5,000 hectares. Additionally, there are other restrictions on how much of this can be used, for example under forestry laws,” BHP said.

“The total area required for the Haju Mine is 660 hectares, all of which is overlapped by logging concessions. Not all of this will need to be cleared. Where possible the Haju Mine project will make use of existing logging roads, with only 7.5 kilometers (5 miles) of new road required outside the mine area to join an existing road network,” BHP said.

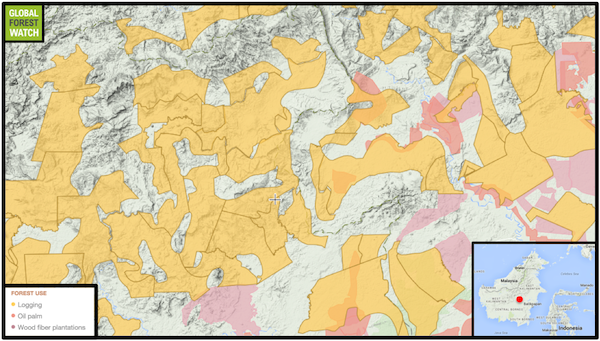

The IndoMet mine complex lies in East and Central Kalimantan, an area already occupied by many resource and agricultural concessions

According to data from Global Forest

Watch, the region of Kalimantan encompassing the mine complex lost

approximately 200,000 hectares of tree cover from 2001 through 2012,

representing nearly 5 percent of the area’s forest cover. While some of

this may be attributable to misinterpretation of plantation harvesting

as forest loss, much of it occurred outside plantation concessions. A

significant amount of intact forest also exists in the area, some of

which is overlain by logging and mining concessions. Map courtesy of

Global Forest Watch. Click to enlarge.

According to the company, an environmental and social impact assessment was approved in 2006. In addition, biodiversity and water management plans have been implemented for the Haju project. Regular monitoring of air and water quality, noise, river sediment, aquatic life, terrestrial fauna and flora in the Haju area will be carried out, the company says, along with extensive engagement with local communities.

BHP says it is supporting conservation initiatives, starting with a two-year project with Fauna and Flora International. Part of this project includes funding for an orangutan reintroduction program managed by the Borneo Orangutan Survival Foundation (BOSF). This program helps orangutans that have been displaced from their habitat in other parts of Central Kalimantan.

The company says it funded the construction of a quarantine facility for up to 50 orangutans at the BOSF Nyaru Menteng Rescue and Rehabilitation Center in Central Kalimantan and has been involved in the safe release of more than 260 orangutans into the wild.

According to the company, an environmental and social impact assessment was approved in 2006. In addition, biodiversity and water management plans have been implemented for the Haju project. Regular monitoring of air and water quality, noise, river sediment, aquatic life, terrestrial fauna and flora in the Haju area will be carried out, the company says, along with extensive engagement with local communities.

BHP says it is supporting conservation initiatives, starting with a two-year project with Fauna and Flora International. Part of this project includes funding for an orangutan reintroduction program managed by the Borneo Orangutan Survival Foundation (BOSF). This program helps orangutans that have been displaced from their habitat in other parts of Central Kalimantan.

The company says it funded the construction of a quarantine facility for up to 50 orangutans at the BOSF Nyaru Menteng Rescue and Rehabilitation Center in Central Kalimantan and has been involved in the safe release of more than 260 orangutans into the wild.

The mine is hundreds of kilometers from the coast and will rely on barges to transport the coal to a port for loading onto ships. This is costly and river transport is available for about nine months of the year because of fluctuating water levels.

A $2.3 billion coal railway to the coast is being considered by the central and provincial governments, but it is unclear if BHP and Adaro would be customers. This article was originally written and posted by David Fogarty, a contributing writer for news.mongabay.com.

IDX to Simplify IPO Requirements for Mining Companies

Fathan Qorib, Christina DesyIt goes without saying that to expand business operations, the availability of sufficient capital is a critical factor for any company. While there are numerous ways to raise capital, one common and attractive method is undertaking an initial public offering and converting a company into a public company.

This is particularly beneficial for companies that require large amounts of capital, as they can keep a lid on expenses by avoiding interest payments, an inevitable outcome when raising capital by bank loans. Under such restraints, the IPO strategy is highly attractive for companies which require large amounts of capital to operate, including mining companies.

While highly encouraged, the number of companies that actually go public have historically been less than estimated targets. The Indonesian Stock Exchange (IDX) targeted around 30 such companies for IPOs in 2014, but approaching the end of the year, to date only 18 companies have done so. The current best estimate for IPOs on the IDX is 25 companies by the end of 2014.

To boost the number of public companies in upcoming years, the IDX is aiming to simplify the requirements for initial public offerings (IPO). However, Ito Warsito, IDX’s President Director, stated that for now such facilities will only be granted to mining companies, especially those that are yet to start production.

For this purpose, the IDX is currently drafting a regulation that will provide mining companies are no longer required to provide their financial statements from the last three years when listing. To proceed with an IPO, mining companies that have not started production will have to prove that they are in the exploration phase and also provide their mining business feasibility studies.

This model has been used by stock exchanges in other countries which have attracted Indonesian mining companies to listed on them rather than the IDX. Once the regulation is complete for mining companies, the IDX will draft a similar regulation for the oil and gas sector.

In the meantime, BEI is also providing guidance to domestic entrepreneurs to better understand capital market mechanisms. While Mr. Warsito cannot state the exact number of future public companies though taking such actions, he is optimistic that familiarization with the capital market will at least increase the awareness of the capital market’s role in optimizing businesses.

This optimism is shared by Hoesen, IDX’s Director of Company Assessment. Moreover, Mr. Hoesen hopes that the incoming Joko Widodo and Jusuf Kalla administration will share the same spirit and start to implement concrete actions for economic growth instead of spending excessive time on discussions and discourse.

IDX to Simplify IPO Requirements for Mining Companies

No comments:

Post a Comment